REGULATORY REPORTING SOFTWARE FOR THE BANK OF ENGLAND SOLVENCY II.

Bank of England Insurance XBRL Reporting.

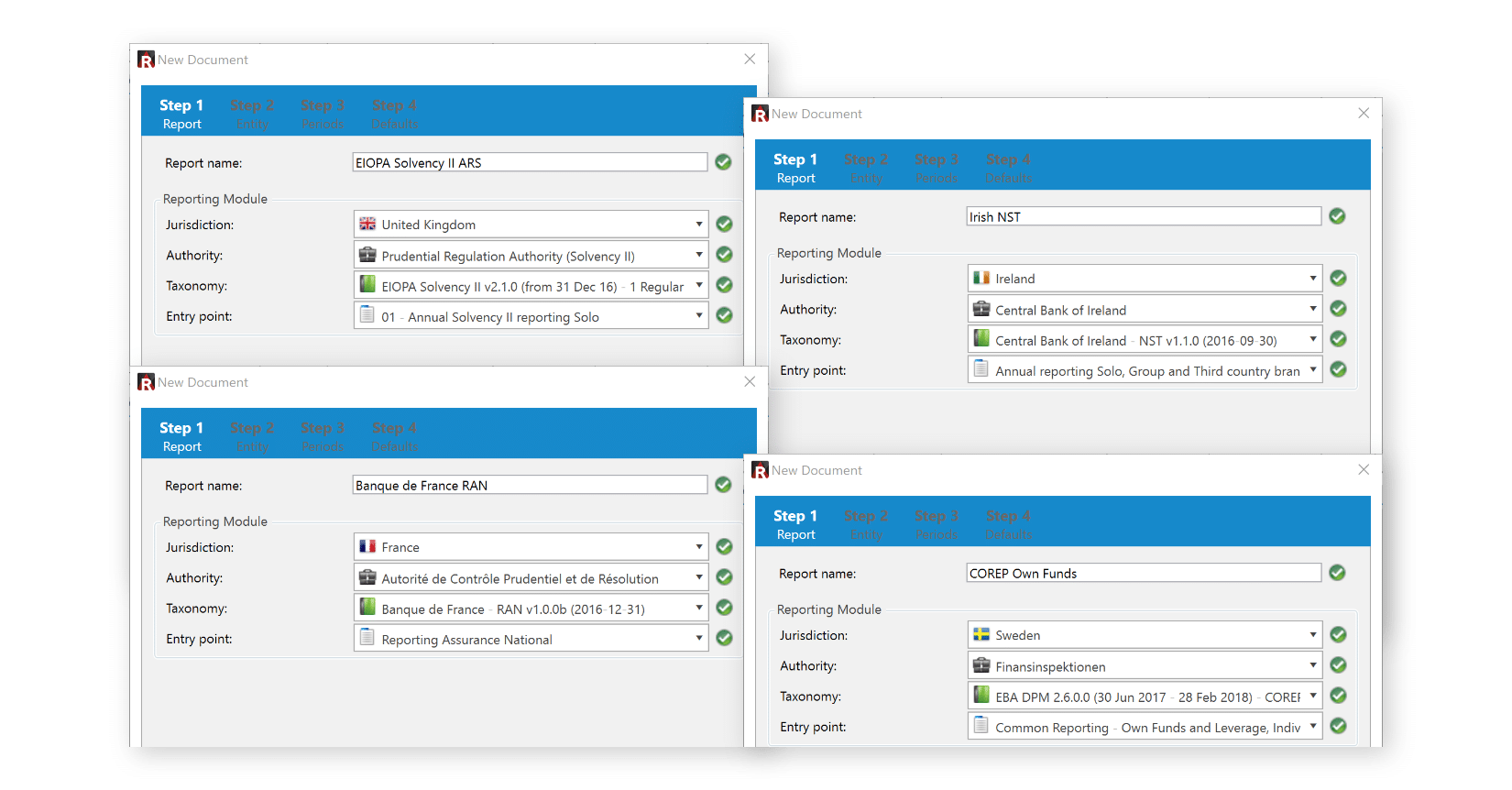

Create reports based on Data Point Model taxonomies for submission in XBRL format.

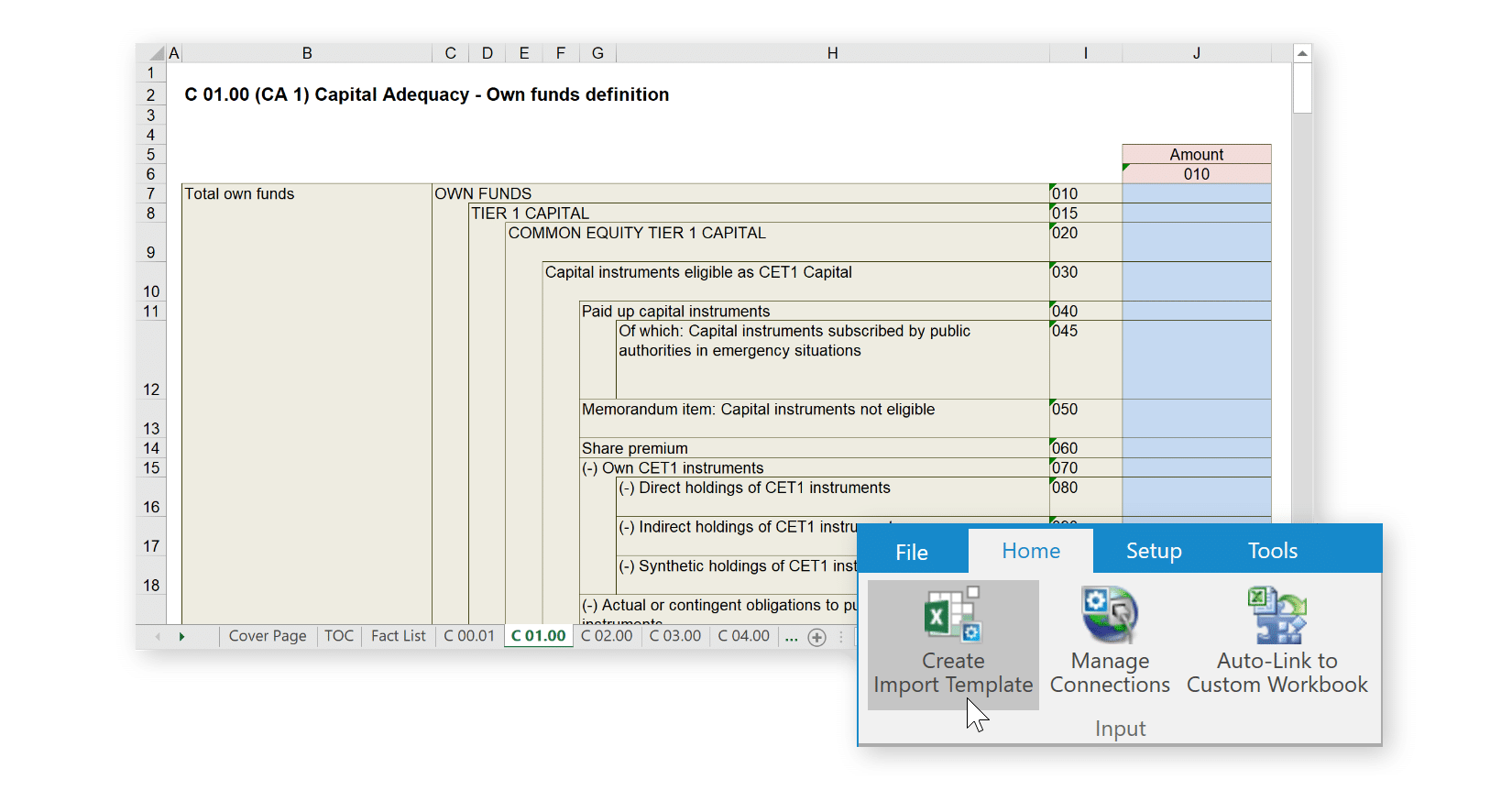

Generate Excel versions of templates to link to data sources and automate calculations.

Integrate directly with data from existing systems such as Oracle EPM (HFM & Essbase), SQL & OneStream.

Easily migrate data mappings and Excel workings from one taxonomy to another.

Introducing DPM Authority.

Learn how DPM Authority can help you simplify and streamline your XBRL reporting.

Bank of England Insurance Reports Supported by

DPM Authority

- AIS – Annual Internal Model Firms Solo

- ALS – Annual Lloyd’s Solo

- ANS – Annual NSTs Solo

- IMO – Internal Model Outputs

- MRS – Market Risk Sensitivities

- QLS – Quarterly Lloyd’s Solo

DPM Authority can support any DPM XBRL Framework. Don’t see the report you are looking for?

Let us know.

HOW DOES IT WORK?

3. Link templates to data sources.

DPM Authority can generate and link to Excel versions of the templates. These workbooks can be used to automate reported data points using calculations and linking to external data sources.

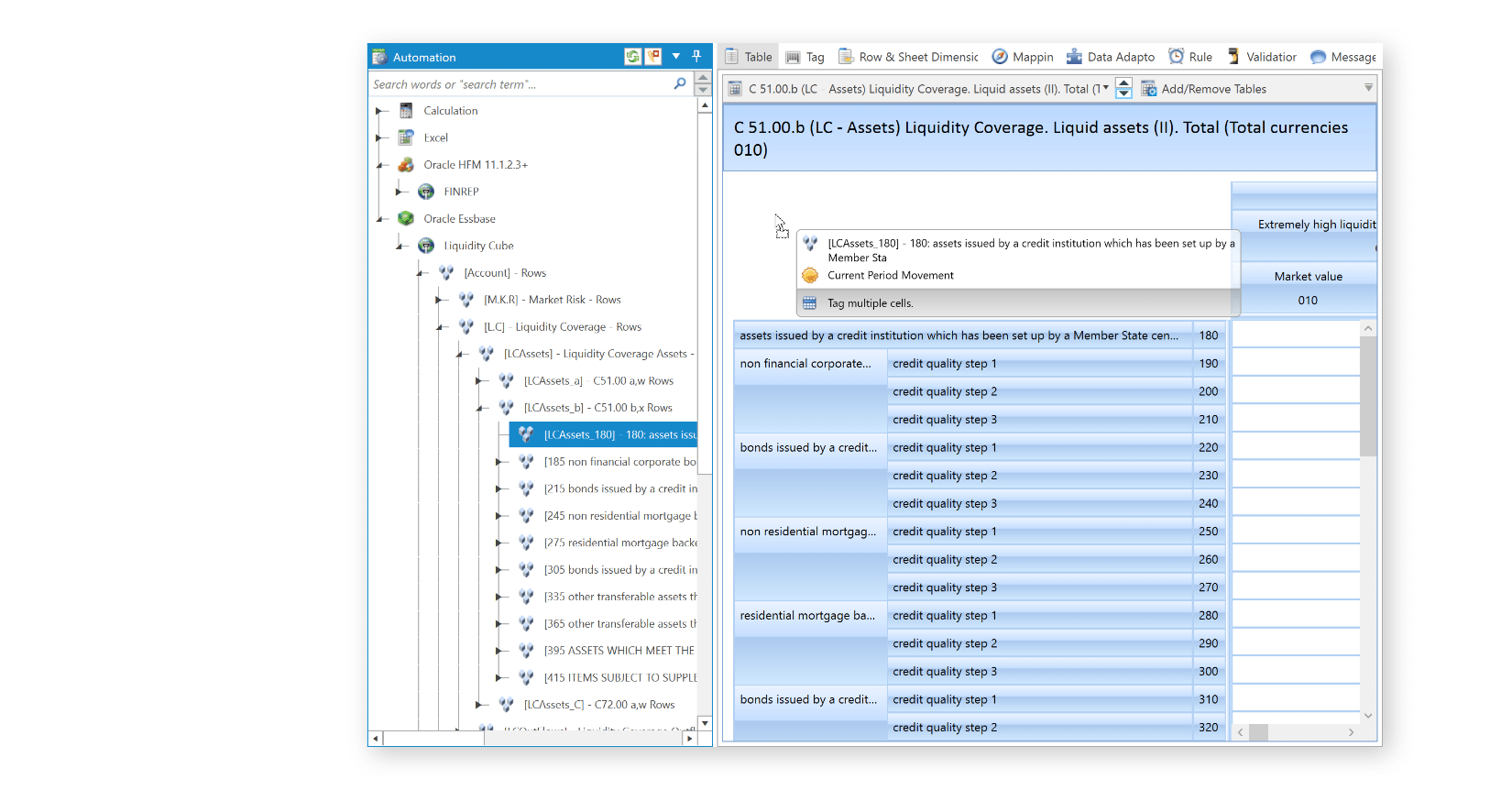

To avoid the need to develop and maintain intermediate Excel workbooks, templates can be mapped using simple drag-and drop functionality to any of the following data sources:

- Oracle HFM, Essbase & Planning

- Microsoft SQL Server

- OneStream.

4. Validate to ensure acceptance of submission.

DPM Authority provides interactive validation results to quickly identify and resolve validation errors that may cause the rejection of a submission by the regulator. Our software uses the same validation mechanism as is used at the regulator’s submission gateway.

REQUEST A DEMO:

- Seeing it operate is the best way to understand how it works.

- We can answer any questions for your specific requirements.

- Together we can assess how our solution will work for you.

- ESMA ESEF

- UK HMRC

- Irish Revenue

- Danish Business Authority

- and many others

- EBA CRD V (COREP & FINREP)

- EIOPA Solvency II

- Single Resolution Board

- National Banking and Insurance

XBRL Reporting

DPM AUTHORITY FEATURES

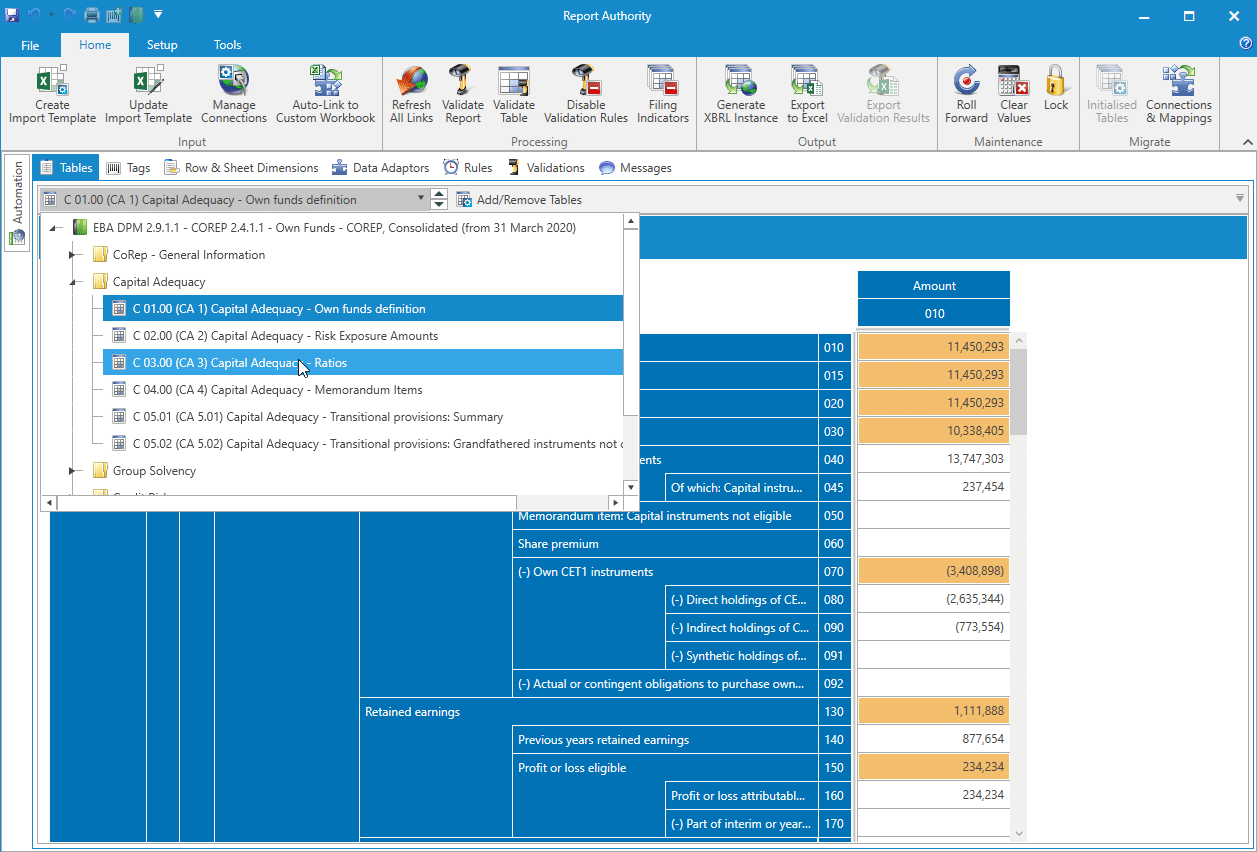

Generate XBRL tagged input sheets by selecting from the list of available templates included in the taxonomy. Generate and link to Excel versions of the sheets for easy population and automation.

Automate the report using a simple drag and drop interface. Link data points to data in Microsoft Excel, Oracle Hyperion HFM, Essbase and Relational Databases.

Validate and resolve data issues using DPM Authority’s interactive validation messages designed to take you right to the cause of any data quality issues.

Export your templates, QRTs or NSTs into XBRL format for submission to your supervisor’s submission gateway.