XBRL REPORTING SOFTWARE FOR The Companies and Intellectual Property Commission of South Africa

CIPC XBRL Reporting Software.

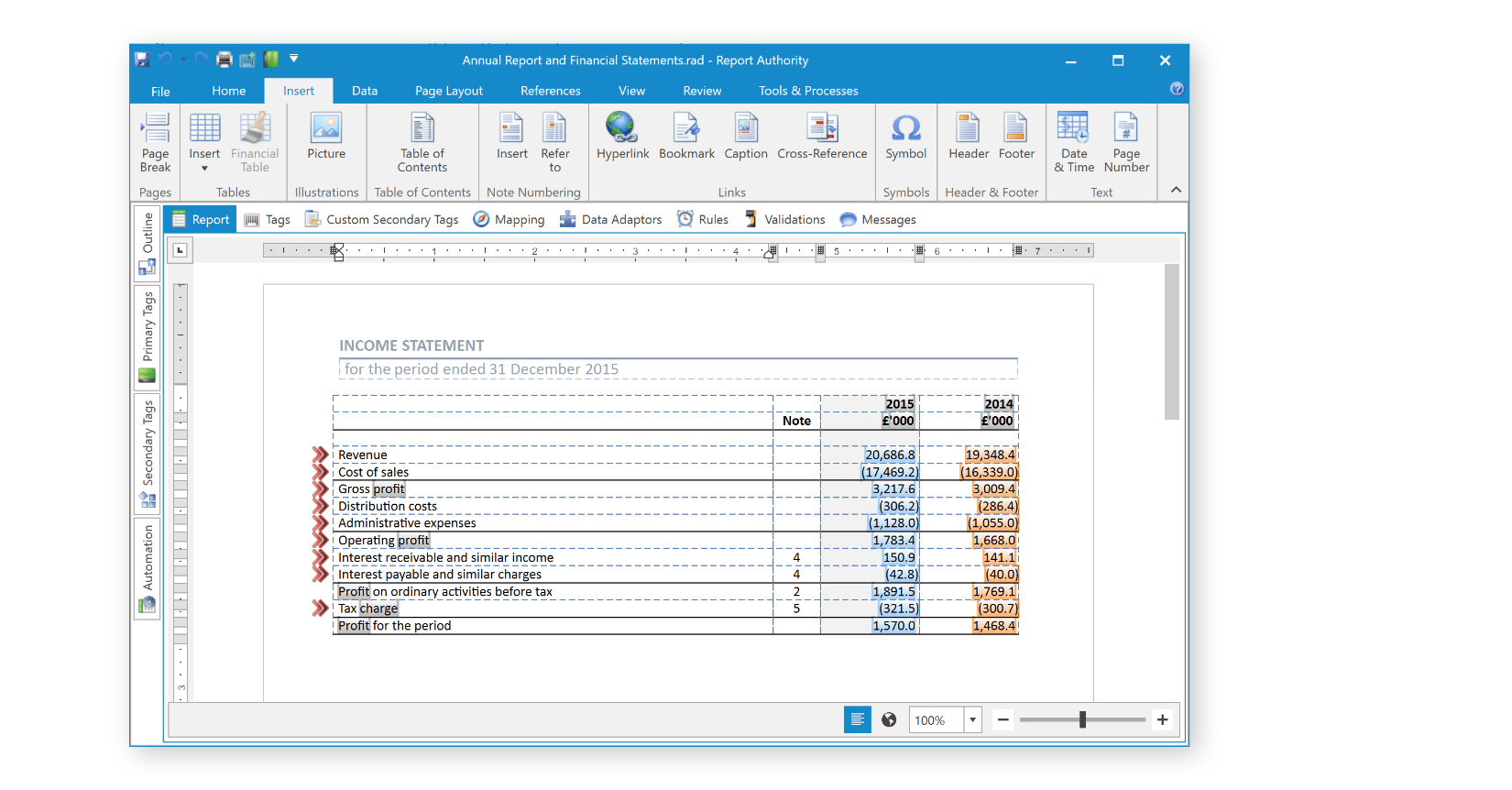

Convert your existing annual financial statements (AFS) into XBRL or iXBRL format with minimal disruption to your existing workflow.

Automate the production of your AFS using powerful automation, calculation, validation and XBRL tagging functionality.

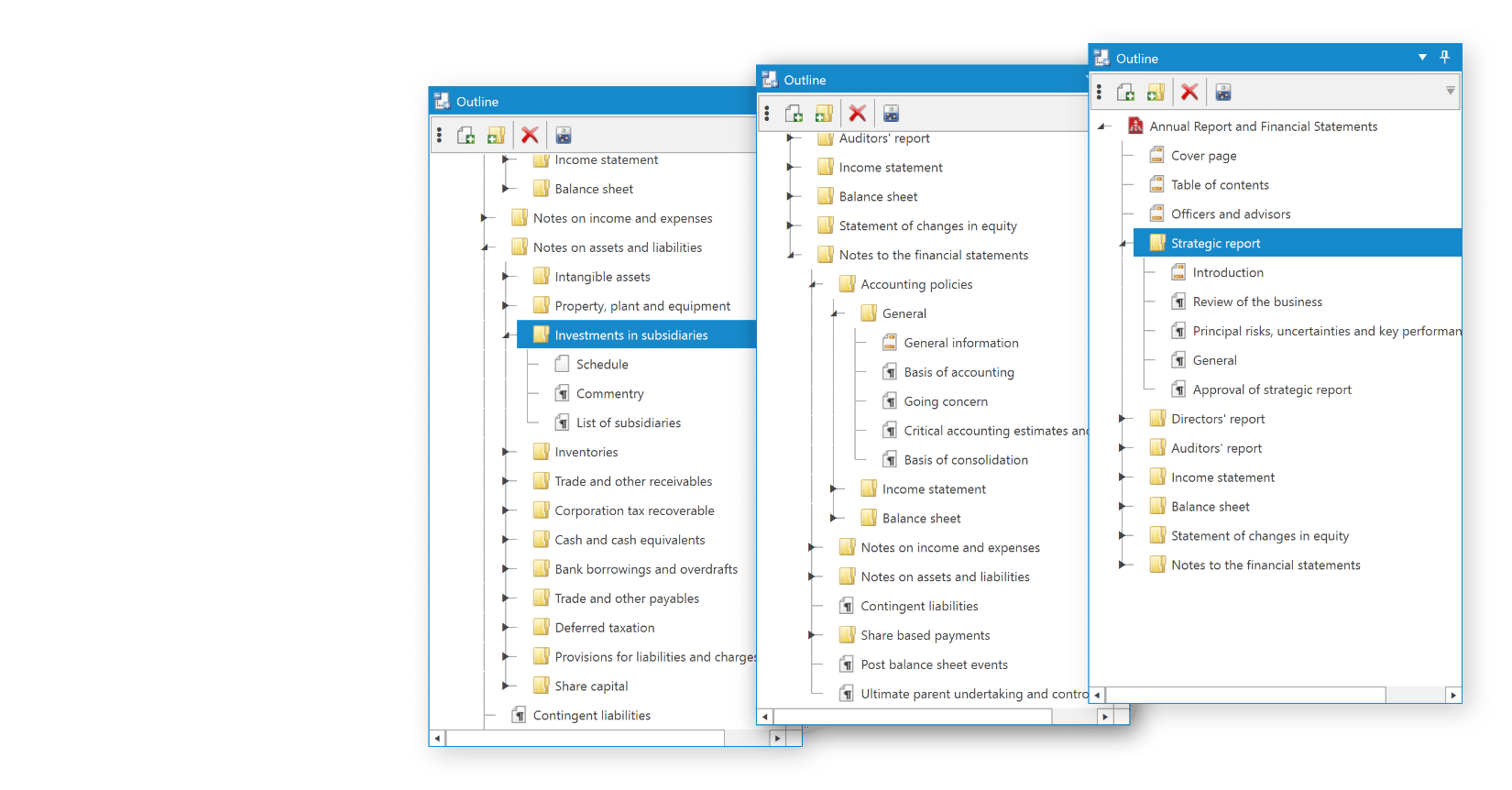

Standardise reports with a single template that adapts report content for each reporting entity.

Link report content to external data sources such as Microsoft Excel, OneStream, Oracle HFM and Essbase.

Introducing Report Authority.

Learn how Report Authority can help you integrate iXBRL in your financial reporting.

How Does it work?

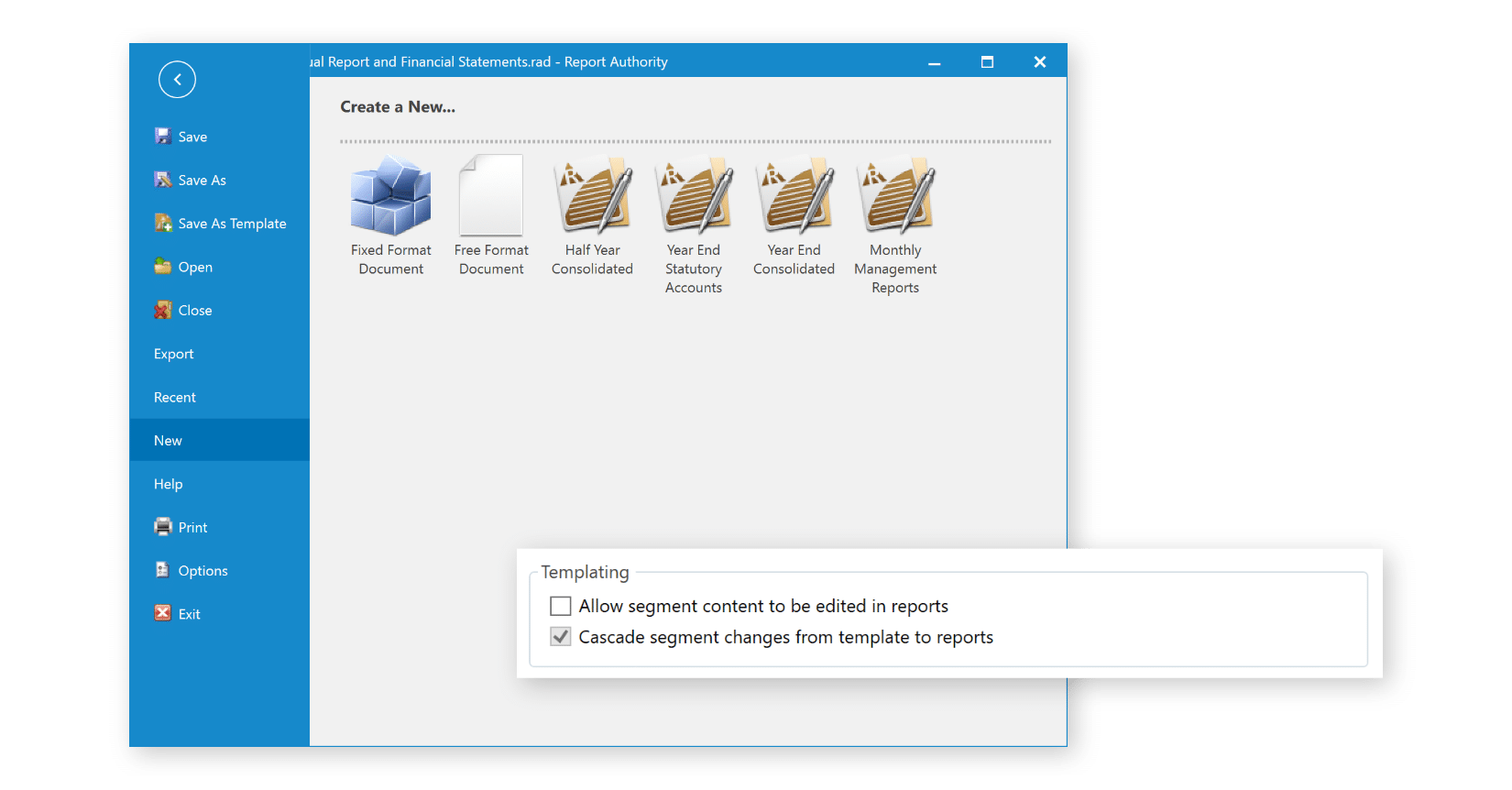

3. Template

Reduce the burden of creating and XBRL tagging many similar reports through the use of Report Authority’s template functionality. Report content can adapt based on values retrieved from data sources allowing a single template to be used by multiple reporting entities with different content.

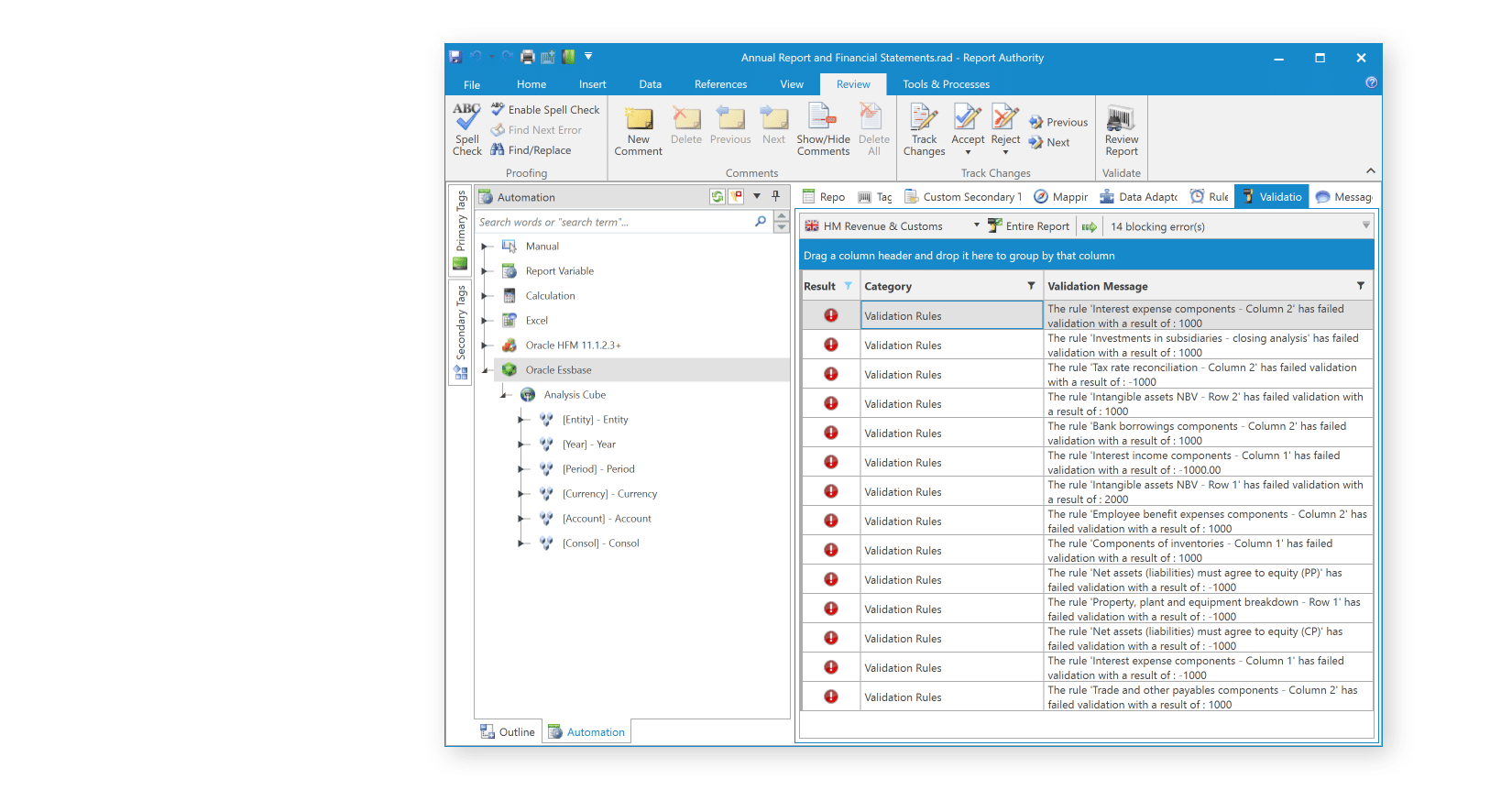

4. Validate

Ensure accuracy of the report through the creation of validations rules that will be checked each time document is printed/exported.

If exporting to iXBRL, Report Authority provides interactive validation results to quickly identify and resolve validation errors that may cause the rejection of a submission by the regulator.

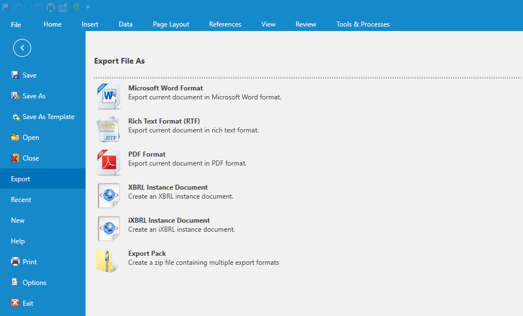

5. Export to Multiple Formats

Report Authority can export to a variety of formats such as PDF, Word, XBRL & iXBRL.

Request a Demo:

- Seeing it operate is an easy way to understand how it works

- We can answer any questions for your specific requirements.

- Together we can assess how our solution will work for you.

- ESMA ESEF

- UK HMRC

- Irish Revenue

- Danish Business Authority

- and many others

- EBA CRD V (COREP & FINREP)

- EIOPA Solvency II

- Single Resolution Board

- National Banking and Insurance

XBRL Reporting

Report Authority Features

Create group and subsidiary financial statements, pillar three qualitative reports, board packs and any other report which combines financial results with commentary.

Link objects in the report to data in Microsoft Excel, Oracle HFM, Essbase, OneStream and Netsuite using a simple drag and drop interface. Create numeric and text calculations and eliminate rounding differences.

Validate the document with using custom validation checks as well as XBRL validation rules that are used at the regulator’s submission gateway.

Export the report into a number of formats including Microsoft Word, Rich Text, PDF, XBRL and iXBRL.